Debt Consolidation vs. Chapter 7 Bankruptcy: Why Consolidation Usually Fails New Yorkers

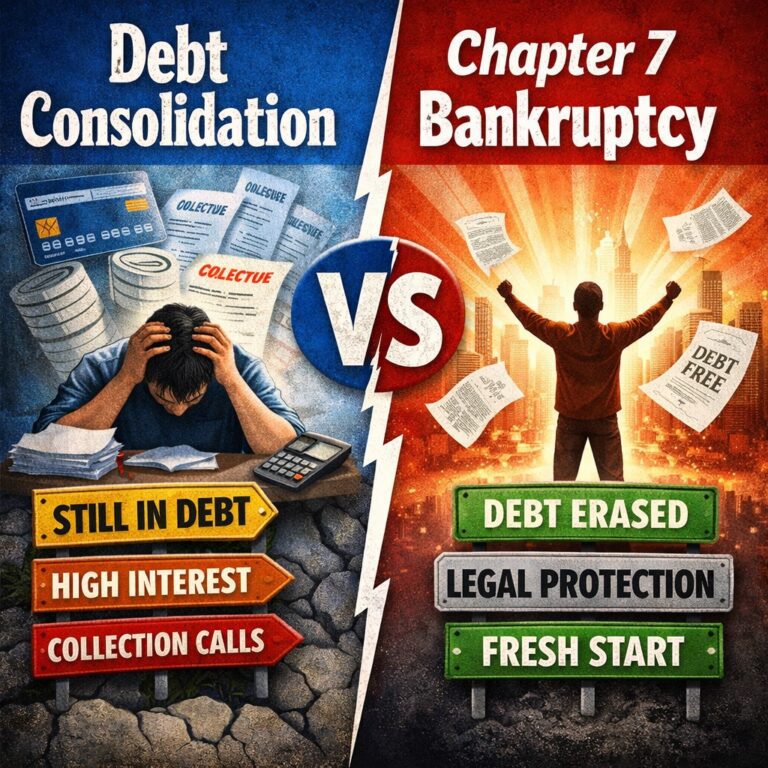

Debt consolidation vs Chapter 7 bankruptcy is one of the most common decisions New Yorkers face when they’re overwhelmed by credit card debt, personal loans, or medical bills. While debt consolidation is often marketed as the responsible first step, it frequently keeps people stuck in debt longer than expected.

However, in real life—especially here in New York City—debt consolidation usually delays the problem and costs more money. By contrast, Chapter 7 bankruptcy is often faster, cleaner, and far more effective at actually fixing the situation.

Let’s talk honestly about why.

Quick Links

- What Debt Consolidation Really Is

- Why Debt Consolidation Fails for Most People

- What Chapter 7 Bankruptcy Actually Does

- Debt Consolidation vs. Chapter 7: A Reality Check

- Why New Yorkers Are Especially Vulnerable

- Final Thoughts

What Debt Consolidation Really Is (and What It Isn’t)

Debt consolidation sounds appealing on the surface. You combine multiple debts into one monthly payment, ideally at a lower interest rate. In theory, it feels simpler.

In reality, here’s what consolidation usually means:

- You still owe 100% of the debt

- Interest usually keeps accruing

- One missed payment can collapse the entire plan

- Many people end up running balances back up again

When comparing debt consolidation vs Chapter 7 bankruptcy, the difference comes down to whether debt is reorganized—or erased.

Why Debt Consolidation Fails for Most People

It Requires Perfect Behavior Under Stress

Consolidation assumes nothing goes wrong. No job interruption. No rent increase. No emergency expense.

In New York, that assumption is unrealistic.

Miss one payment and suddenly:

- Interest rates jump

- Fees pile up

- Your credit takes another hit

Now you’re worse off than when you started.

It Offers No Legal Protection

Creditors can still sue you. Wage garnishments, frozen bank accounts, and judgments in New York civil court are all still on the table.

Debt consolidation provides zero legal protection.

It Often Costs More Over Time

Because balances remain and interest continues, many people pay thousands more over several years—only to end up filing bankruptcy anyway.

We see this pattern constantly.

What Chapter 7 Bankruptcy Actually Does

Chapter 7 bankruptcy doesn’t juggle debt. It eliminates it.

For most unsecured debts—credit cards, personal loans, medical bills—Chapter 7 can wipe the slate clean in about three to four months.

No repayment plans. No negotiations. No guessing.

Immediate Legal Protection

The moment a Chapter 7 case is filed, an automatic stay goes into effect. That means:

- Collection calls stop

- Lawsuits pause

- Wage garnishments end

- Bank levies freeze

This protection is immediate, real, and enforceable under federal law.

Debt Consolidation vs Chapter 7 Bankruptcy: A Reality Check

Debt Consolidation

- Debt remains

- Interest continues

- No court protection

- High failure rate

- Often delays bankruptcy anyway

- Most unsecured debt erased

- No repayment plan

- Strong legal protection

- Clear timeline

- True financial reset

When people tell us, “I wish I’d done this sooner,” they’re almost always talking about Chapter 7—not consolidation.

Why New Yorkers Are Especially Vulnerable to Consolidation Traps

Between rent, utilities, transportation, and food, there’s very little margin for error in NYC. Consolidation plans assume disposable income that many people simply don’t have.

We routinely see clients from Manhattan, Brooklyn, Queens, and the Bronx who tried consolidation for years—only to fall further behind.

Chapter 7 exists for exactly this situation: high cost of living, limited flexibility, and overwhelming unsecured debt.

Final Thoughts: Clarity Beats Prolonged Stress

Debt consolidation sounds responsible. Chapter 7 feels scary—until you understand it.

Once people see how fast and final Chapter 7 really is, the comparison becomes simple. One delays the pain. The other ends it.

If you’re going to do something, do the thing that actually solves the problem.